Squeeze continues - labour market data

Labour market data released today showed the unemployment rate still pretty stubborn, at 7.8%. Employment continues to grow, including in full time employment.

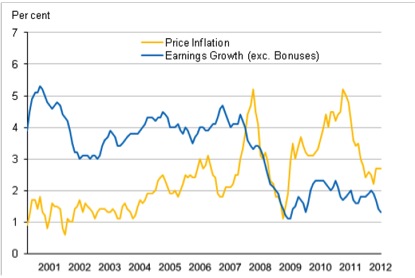

Wages data were also released. Excluding bonuses, average wages increased by 1.3% (Q4 2012 vs Q4 2011). This compares with an inflation rate at the end of the year of 2.7%. The

Office for National Statistics produced the following graph to illustrate the gap between rises in prices and growth in incomes:

Data out so far suggests household disposable incomes rose last year but that the savings ratio also rose (to Q3). That suggests households focused on saving and/or paying down debt, rather than spending. Some economists believed that income available to spend after bills had been paid would rise this year. That may still happen with the increase in the personal allowance from April. However, the inflation outlook has changed and generally a higher rate is expected this year now and driven by what the Bank of England calls 'administered and regulated prices' eg utility bills, passenger transport costs, tuition fees etc.

This presents a challenge for economic policy-makers. Living standards are continuing to fall - and it seems that is due in large part to government policy. Yet utility and other services have to be paid for somehow.

Stephen Beer, 20/02/2013