Labour's national duty

UK back in recession territory - Tories losing credibility but Labour has more to do.

Labour has spent years now worrying about how to gain credibility on economic policy. Meanwhile, the Conservatives and Liberal Democrats are making a good job of losing it. The UK now appears to be back in recession. Ahead lies the risk that the economy will go backwards this year and put deficit-cutting plans further into doubt. Labour, however, cannot simply wait and hope to gain a durable reward from the government’s travails.

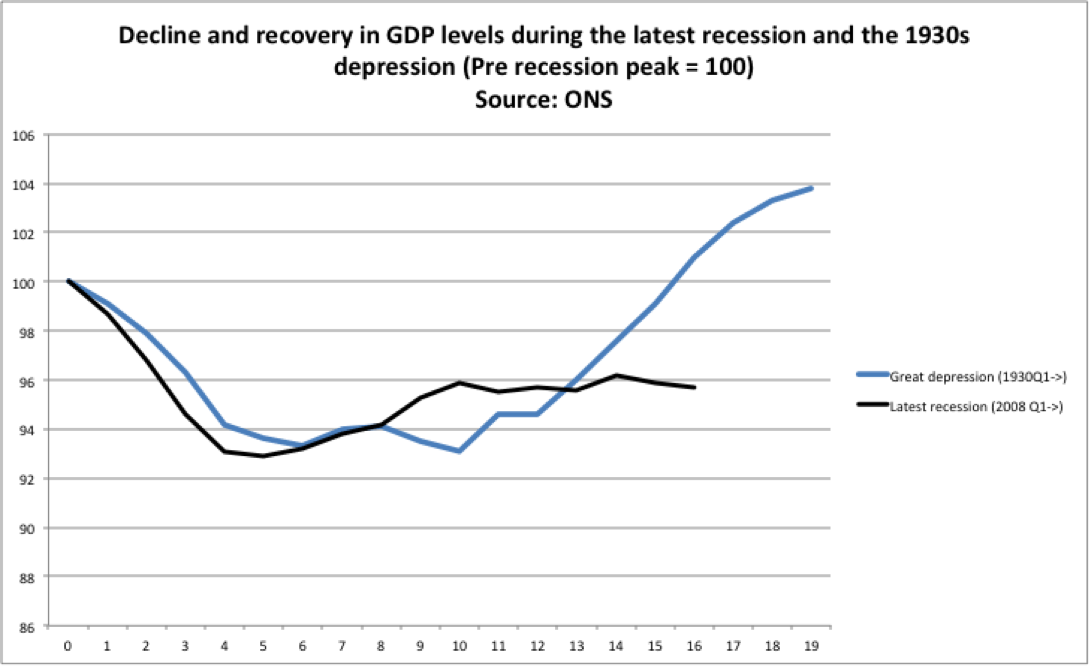

The preliminary estimate of GDP growth in the first quarter this year shows national income falling 0.2 per cent rather than rising slightly as many had expected. Put together with the 0.3 per cent fall in Q4 2011, that equals a recession on the conventional definition. Compared with the first quarter last year, the UK economy is flat. Of course it could be said that, since output is still way below the level before the financial crisis, we never emerged from the deep recession. But these figures just out suggest that the economy is not even gradually climbing back to former heights. Any momentum appears to have been lost. It was lost when George Osborne started comparing the UK to Greece and talking up ‘austerity’. In the sobering judgement of the Office for National Statistics Economic Bulletin: ‘The stuttering nature of growth following the recession means that the economy is weaker relative to its pre-recession peak than at the corresponding stage of the depression in the early 1930s. It is also well below where it would have been if it had followed the path of either of the recessions in the early 1980s and early 1990s.’ That was not inevitable. The recovery stalled in 2010.

The GDP figure is a first estimate. The ONS calculates it by using hard data where it can and relying on survey evidence and forecasting to complete the picture. An important swing factor is the construction sector, which makes up 7.6 per cent of GDP and can be subject to significant revisions. The ONS believes output from construction fell three per cent in Q1. However, it notes that construction output would have to have improved by 40 per cent in March for the sector to have grown in the quarter. It is possible there could be an upward revision, which might move the Q1 GDP growth estimate to nearer flat. Elsewhere in the economy, the services sector grew slowly and industrial production fell slightly in the quarter.

Whether or not the recession is confirmed, the UK economy is not in a great state. Eurozone travails may dent economic confidence further if European leaders do not act decisively, and we will need to await election results, particularly in France, for the next phase of economic policymaking. Europe does give us a lesson in what happens when nations pursue austerity – spending cuts and tax rises – without growth: they get drawn into an austerity death spiral where fiscal retrenchment hits growth, which hits tax revenue, which leads to further spending cuts and tax rises, which lead to recession. The fiscal orthodoxy does not even have a political mandate in much of Europe, which means it cannot deliver. Back in the UK, Conservatives and Liberal Democrats talk occasionally about promoting growth, but don’t actually do anything meaningful about it.

The temptation for Labour is to repeat our mantra that the government is cutting too far and too fast. Actually, that’s not a bad start because we are right. We have to do more, however, because even a Tory double-dip recession will not be enough to restore economic credibility for Labour. Underlying the poor figures are people out of work or, as the latest employment figures showed, forced to take part-time jobs because they cannot find full-time work. At the same time, most people’s living standards are being eroded by inflation. Labour’s message must be convincing here and our theme should be ‘investing in our future’. We still need to gain credibility with markets too. There is a good opportunity now because investors are worrying about growth. They fear that countries will be burdened with public debt for many more years to come unless their economies pick up. There is a great prize of credibility for political leaders who can convincingly show how they will control and cut deficits while committing steadfastly to promoting growth. This is not just an opportunity for Labour – it is a national duty.

This article was first published online by Progress on 26 April 2012.

Progress, 26 April 2012, 26/04/2012