One Nation ambition

Our economic policy must be credible from the point of view of voters, as well as markets

Labour party members from across the political spectrum will be at Progress annual conference tomorrow to discuss the next steps for One Nation Labour. A good start would be to take a look at the economic context. Our economic policy must be credible with markets. It must also be credible from the point of view of the voter and citizen. That means having clear answers to the challenges people are facing today.

Recent economic data suggests the economy is in slightly better shape than a month or so ago. For example, April’s Purchasing Manager Indices improved and were ahead of expectations, even if not changing the generally flat outlook. However, this month’s Economic Review from the Office for National Statistics reminds its readers of some sobering information. Compared with the past three recoveries, the current one lags well behind. In the first five quarters after the recession, the UK economy grew at an annual rate of 2.2 per cent. Since then, and since the coalition has been in office, the annualised growth rate has been just 0.5 per cent. Even if we were to assume that the UK economy now has a lower trend rate of growth than before the recession, the situation still looks bleak. If we thought the trend rate was no longer above two per cent but instead was something like 1.5 per cent, the economy would still be underperforming (that does suggest we might see some strong quarters of growth at some point).

Despite moves by government and the Bank of England to boost the supply of credit, borrowing demand growth is low. This comes down to economic confidence. If businesses cannot be sure about the outlook for demand in the future, they will be reluctant to make investments in new machinery, another factory or warehouse, or more jobs. In uncertain times, households will be more likely to pay back debt or save rather than spend.

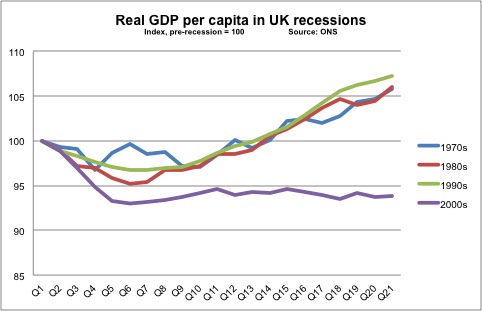

It is no wonder household confidence in the future seems subdued. Average weekly wages are currently rising around one per cent annually but inflation is around three per cent. Moreover, compared with previous recoveries, GDP per person is stagnant. This is a woeful performance. The chart below shows GDP per capita after the last four recessions, including the last one. While each recession saw income per head fall, it recovered rapidly. The current ‘recovery’, accompanied by a sharper rise in population than previous occasions, has shown no such sign.

The lack of economic growth is not only widening the gap between reality and the potential growth we could have, it is also eroding standards of living year on year. In this context, economic policy has to improve this situation or people will not believe it to be credible. We are rightly concerned about how to boost growth and, whether GDP performs better or worse than forecasters predict, we need to help boost household confidence in the future. This needs to be on a scale that matches the challenge the country faces. Distribution of income matters too. The recession reduced income inequality as incomes fell sharply. Any growth needs to be experienced across society rather than the gains accruing mainly to those at the top.

A One Nation economic policy around the theme of investment offers some hope. It can combine Keynesian macroeconomic measures to encourage growth with a commitment to help people invest in their future. We would be saying that we would boost education and training resources, emphasise our jobs guarantee and overhaul the way we help young people find work. The idea is that everyone can be involved in the growth of our economy, see a decent return for their effort, and be able to adapt to the changing economic situation. We should not be talking about tinkering with the system. The circumstances demand that our ambition should be greater.

Progress, 10 May 2013, 11/05/2013