Welcome to OBR world

Labour is right to stress that it will cut the deficit it will inherit after the election in May. The party has continued to lag in polling on economic credibility, and in particular on cutting the deficit (see a recent YouGov poll). Ed Miliband’s speech was an important step and the message will need to be repeated. To reduce the credibility deficit, Labour needs to show it will reduce borrowing and control spending. The zero based spending review is vital here, and in my view some sort of ‘effective spending guarantee’ is needed too. However, not only does the debate about economic credibility and deficit cutting take place in the virtual world of OBR forecasts, the future those forecasts predict is somewhat depressing. It would be a mistake to think that getting the deficit down will solve our problems. Miliband was right to stress the economy needs to be reformed. The extent to which this has to happen has yet to be widely comprehended. The latest forecasts from the Office for Budget Responsibility show the government once again on course to meet its fiscal target, but a closer look should make us ask questions about what the economy looks like in 2020 according to the OBR.

The recession and the rise in government borrowing arose from a severe banking crisis. If we look before the crisis we can see that living standards had already been deteriorating as wages fell behind inflation. Households took on more debt and banks were willing to lend. There is a very good case that in the US the use of debt to cover for rising inequality led to the crisis. Everyone thought the prevailing conditions would remain forever, so borrowing increased further. There were echoes in the UK. There was more going on than rising income inequality. Arguably, the rise of highly paid people in the financial sector, intermingled with the celebrity culture celebrating the fabulously rich, changed our society to some degree. We did not see so clearly what was worth valuing. When the collapse came, those in debt scrambled to get their financial situation in order while facing job losses or lower pay. As this happened, government borrowing rose accordingly.

Now, the Tory-Liberal Democrat government claims it will get government borrowing down. Yet the economy is much smaller than the pre crisis trend rate of growth would suggest. The rise in employment, and fall in unemployment, have been welcome surprises. It is far better to be in work than out of work. However, many of the new jobs are low paid and the increase in the number of self employed probably hides many who are low paid too, according to the OBR. Moreover, productivity – the output of the economy per number of hours worked – has failed to recover strongly. The OBR believes it will increase, but slowly. Increasing productivity is the sustainable way to reduce the cost of living. Therefore, we need radical policies that will do this, including a large boost to education and a boost to infrastructure spending, both on building and on digital technology.

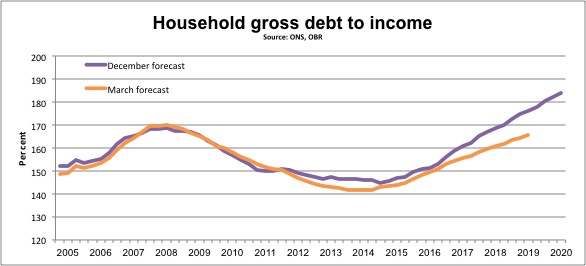

In the OBR’s forecasts, this does not happen (because the government does not have any credible policies that will do the job). Instead, the OBR believes households will borrow more, principally to fund housing costs. It forecasts a 31 per cent increase in house prices by 2020. In a significant change to its earlier forecasts, the OBR now believes that by then household debt as a proportion of income will be higher than at the beginning of the financial crisis and still rising.

The Conservative-Lib Dem deficit-cutting plans rely on families borrowing more. George Osborne’s boasts about cutting spending and his lectures about deficits rely upon people borrowing more.

There has to be a serious question about the extent to which this scenario is sustainable, or possible. It should be seen in the light of forecasts of slow increases in productivity and wages and the implication that a lower pay economy is here to stay. The seeds of another economic crisis are being sown.

Welcome to OBR World. Where the government has always been on course to meet its deficit-cutting target. Where spending can be slashed with no consequences or questions about sustainability. Where the economy is already running close to full capacity but never quite gets there, so the government has time to meet its target. Where we go back to the future with an unequal society relying increasingly on debt and the economy keeps growing smoothly. Welcome to five wasted years of coalition government and in May next year one of the greatest economic challenges facing an incoming government. Let us aspire to have the vision and the will to meet that challenge.

This article was first published by Progress on 12 December 2014.

Progress, 12 December 2014, 13/12/2014